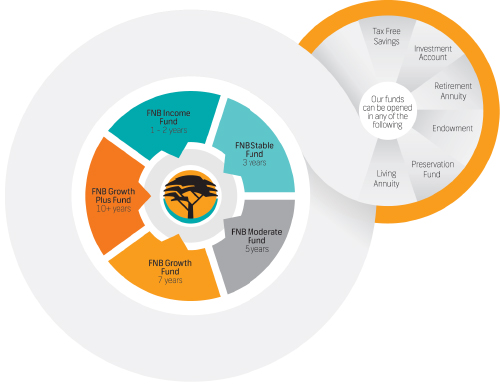

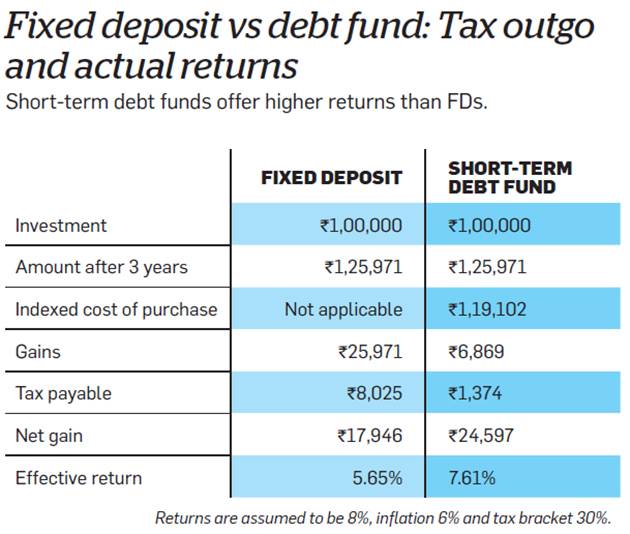

Put it this way, is there an investment where one can get at least 7% to 7.33% interest and have that interest either automatically transferred into a savings account or otherwise. To close off, Im struggling to see the difference in options between 'Absa bank fixed deposits' and the money market. Best games to play to earn real money. Call Deposit Fixed Deposit 32 Day Notice Deposit Flexi Fixed Deposit Borrow Personal loan Home loans. El royale casino 100 no deposit bonus codes. Pricing guides Forex rates Savings + investments interest rates FirstRand share price.

Discover more about ACCOUNT Interest Rates

* Member FDIC * Rates and APY effective and accurate as of March 18, 2020

Deposit Accounts

- . NACM (nominal annual compounded monthly) (Interest is calculated on a daily balance and credited monthly) All rates are tiered depending on account balance.

- The interest earned on an Inflation-Linked Deposit is calculated using the inflation rate (a variable rate), together with a fixed top-up rate. Inflation-Linked Deposit Return = Inflation Rate (variable) + Top-Up Rate (fixed) Inflation-Linked Deposit Rate.

- By offering you a Flexi Fixed Deposit account from just P100, we're making it easy for you to save for your goals and grow your hard-earned cash. Investment options Two investment term options are available being the 6-months and 12-months investment accounts where the interest rate on any given day is directly linked to the prevailing prime rate.

| Account Type | Minimum Deposit | Interest Rate | APY |

|---|---|---|---|

| First Choice Account | $50 | .05% | .05% |

| SuperNow (SNA)* | $2,000 | .05% | .05% |

| Money Market (CMA)* | $3,000 | .10% | .10% |

| Statement Savings* | $25 | .10% | .10% |

| Christmas Club* | $5 | .25% | .25% |

* Penalty for early withdrawal may be imposed.

* APY means Annual Percentage Yield

* Fees may reduce earnings

* Rates are variable and may change after account is opened

* APY means Annual Percentage Yield

* Fees may reduce earnings

* Rates are variable and may change after account is opened

Certificate of Deposit

| Account Type | Minimum Deposit | Interest Rate | APY |

|---|---|---|---|

| 3 month CD | $1,000 | .10% | .10% |

| 6 month CD* | $1,000 | .20% | .20% |

| 10 month CD | $1,000 | .25% | .25% |

| 12 month CD* | $1,000 | .25% | .25% |

| 18 month CD* | $500 | .30% | .30% |

| 24 month CD* | $500 | .35% | |

| 30 month CD* | $500 | .40% | .40% |

| 36 month CD* | $500 | .45% | .45% |

| 60 month CD* | $500 | .50% | .50% |

| See Officer | $250,000.01 | -- | -- |

* Interest may be compounded quarterly

* Monthly check only if over $50.00

* APY means Annual Percentage Yield

* No monthly compounding on any CD

* A penalty will or may be imposed for early withdrawal.

* Monthly check only if over $50.00

* APY means Annual Percentage Yield

* No monthly compounding on any CD

* A penalty will or may be imposed for early withdrawal.

Retirement Accounts

| Account Type | Minimum Deposit | Interest Rate | APY |

|---|---|---|---|

| IRA (Traditional-Variable)* | $100 | .30% | .30% |

| IRA (Roth-Variable)* | $100 | .30% | .30% |

| IRA (Educational-Variable)* | $100 | .30% | .30% |

| IRA (Guaranteed-Fixed)* | $500 | .10% | .10% |

* Interest compounded monthly

Fnb Fixed Deposit Interest Rates History

* APY means Annual Percentage Yield

* A penalty will or may be imposed for early withdrawal.

* Retirement Account Rates (except for the Guaranteed Fixed IRA) are variable and may change after the account is opened.

* A penalty will or may be imposed for early withdrawal.

* Retirement Account Rates (except for the Guaranteed Fixed IRA) are variable and may change after the account is opened.

CDARS

| Account Type | Minimum Deposit | Interest Rate | APY |

|---|---|---|---|

| 3 month (13 wk)* | $250,000.01 | .15% | .15% |

| 6 month (26 wk)* | $250,000.01 | .25% | .25% |

| 1 year (52 wk)* | $250,000.01 | .30% | .30% |

| 2 year (104 wk)* | $250,000.01 | .40% | .40% |

| 3 year (156 wk)* | $250,000.01 | .50% | .50% |

State Bank Fixed Deposit Rates

* APY means Annual Percentage Yield.

* Fees could reduce earnings on an account.

* A penalty will or may be imposed for early withdrawal.

* Deposit Account and Retirement Account Rates (except for the Guaranteed Fixed IRA) are variable and may change after the account is opened.

* Fees could reduce earnings on an account.

* A penalty will or may be imposed for early withdrawal.

* Deposit Account and Retirement Account Rates (except for the Guaranteed Fixed IRA) are variable and may change after the account is opened.